Overview

SmartSimple facilitates the automatic verification of organizations through multiple databases, including the Internal Revenue Service (IRS) and Canadian Charities (CRA).

System Administrators have the capability to establish automatic monthly verifications for organizations categorized under specific categories against these databases, with the results recorded as transactions in the organization’s profile.

Database Check Records on the Organization Profile

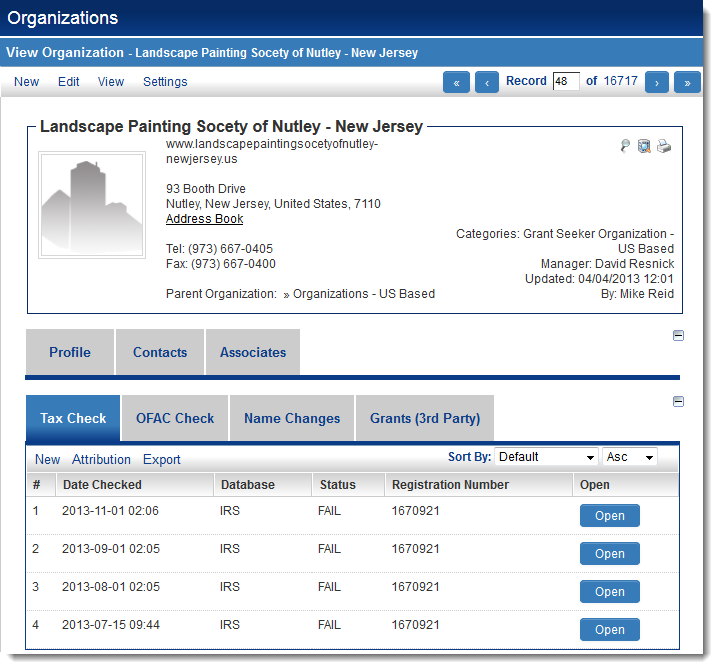

When properly configured, this feature will present each verification against the online database as a transaction within the Organization profile. Distinct types of checks may be displayed under separate tabs.

In the example below, verifications against the IRS database are stored under a tab labeled "Tax Check":

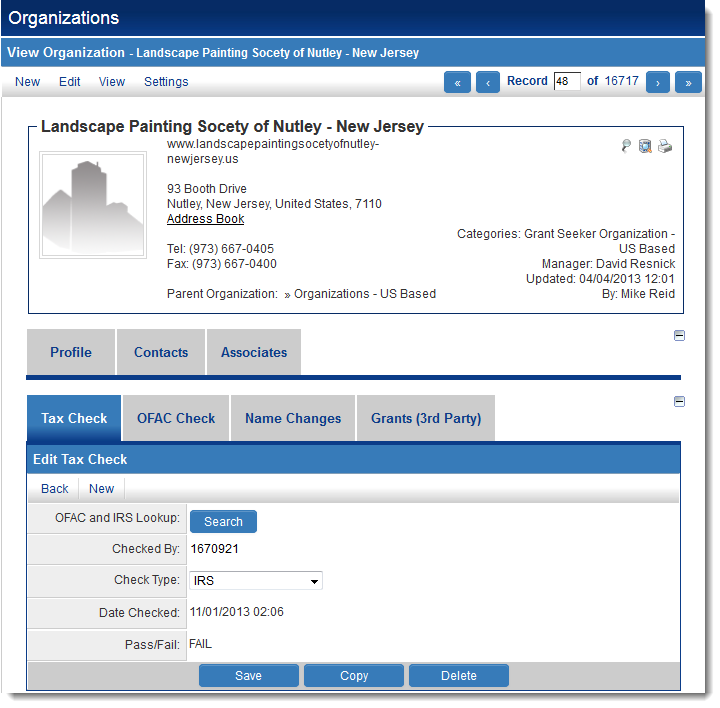

By clicking the Open button, the specific tax check transaction will be displayed:

- The details of the verification can be shown, including the date the check was conducted and a notification indicating whether the record was found in the IRS database.

- In this instance, a FAIL message was displayed, signifying that the organization was not located in the IRS database.

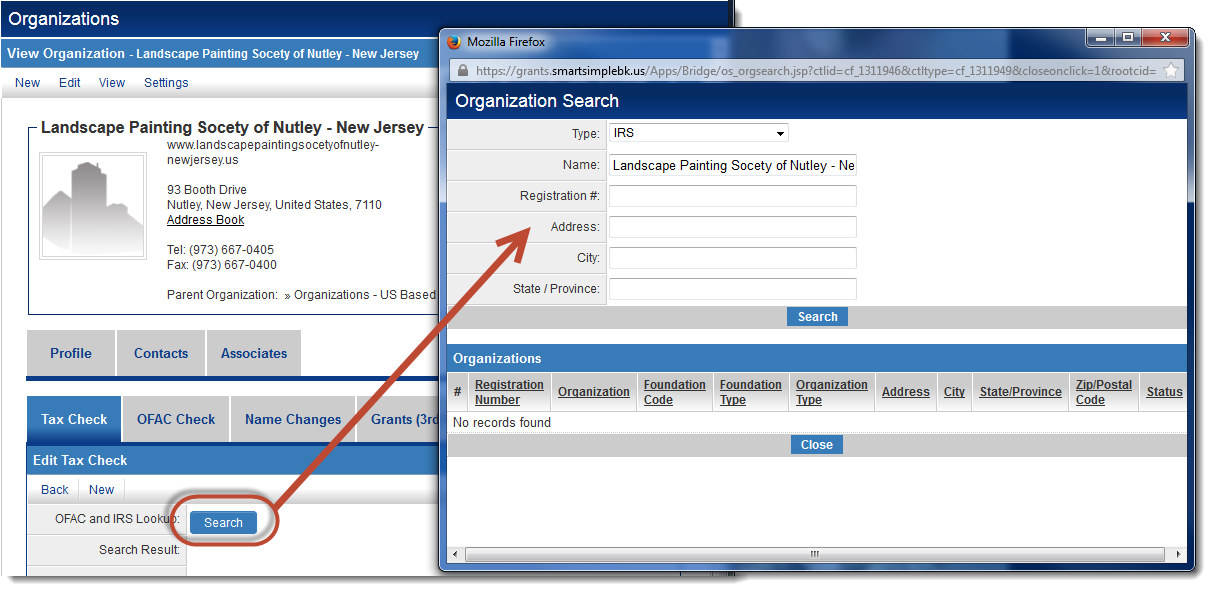

From the specific tax check, an additional verification against the online database (in this instance, the IRS database) can be manually initiated by clicking the Search button:

Configuration

To configure this feature, please follow these steps:

- Select the Types hyperlink from the Global Settings menu located under the Transactions tab.

- Choose the Transaction Types for which you wish to enable automation.

- Activate Use Third Party Verification Service, then select the Default Verification Service you wish to utilize for synchronization with the external database.

- Click the Save button.

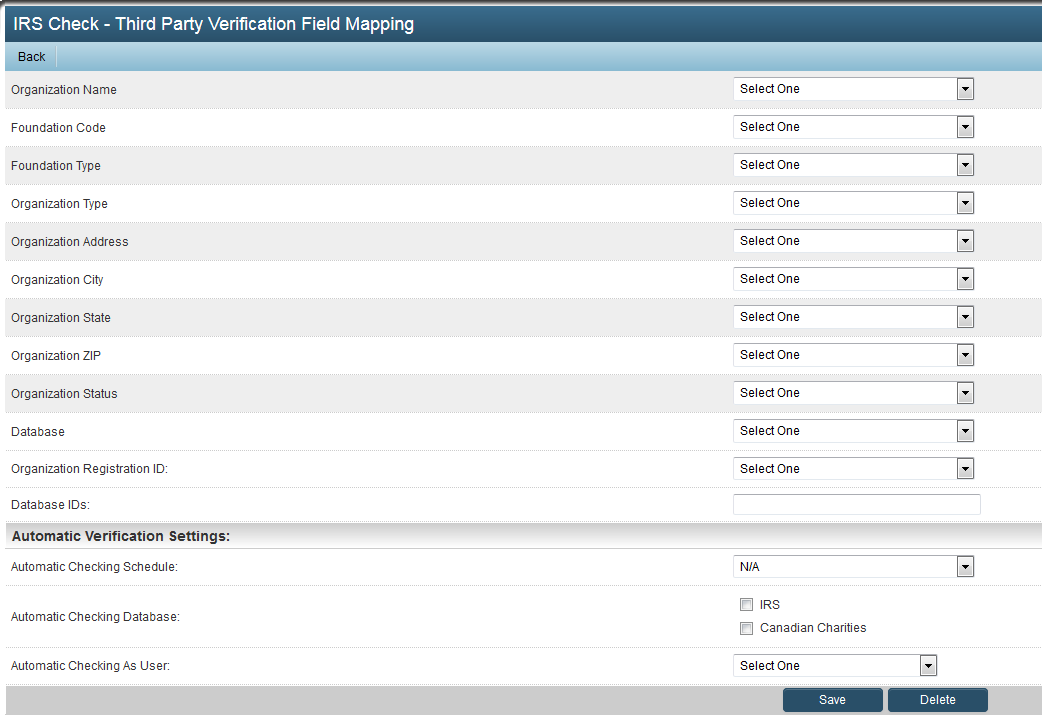

- You will then observe a button at the top of the page labeled Verification Mapping. Clicking this button will redirect you to the subsequent page.

On this page, you can select the custom fields created within the Transaction that will retain the values returned from your search of the external database.

The Organization Registration ID setting allows for the selection of a custom field on the organization profile that will store the outcome of the search.

Under the Automatic Verification Settings heading, you may configure the following options:

- Automatic Checking Schedule: This can be set to N/A, Once a month, Once every two months or Once every three months.

- Automatic Checking Database: You may select from IRS, Canadian Charities, and OFAC.

- Automatic Checking As User: This is a dropdown field that provides a selection of internal users within your system.

Notes

- If any information in the IRS verification service appears missing or incorrect, please note that the data comes directly from the IRS. The IRS releases updated files monthly, and we refresh our records on the 16th of each month. If you notice a discrepancy, check back after the 16th to see if the IRS has corrected or added the data.